ATB, a co-creation story

Overview

Introducing a new method of product building, one that worked with our users and utilizing the potential of the Trio

At ATB, I led the redesign of a high-friction wire transfer experience by applying service design principles and centering co-creation as a core method for reducing friction across service layers. The initiative tackled a system-wide pain point. Confusing language, and lack of support, impacting both customers and frontline staff. By rethinking the service journey we reduced user errors, minimized support burden, and delivered a solution three times faster than traditional methods.

Client: ATB

Role: Senior Product Designer

Duration: 2 months (July 2024)

Team: Product, Research, Engineering

The service challenge

Wire transfers, especially international ones, were a persistent point of failure within ATB’s business banking service ecosystem. This touchpoint generated high call volumes and customer dissatisfaction, pointing to systemic service issues such as:

Poorly integrated information architecture across the digital and support layers

Ambiguous financial terminology (e.g., “beneficiary” vs. “creditor”)

No service-level visibility (e.g., fees, settlement timelines)

Over-reliance on human intervention for resolution

The opportunity: to reimagine wire transfers as a seamless, self-serve journey through, information clarity, and embedded support.

My role

As Senior Product Designer, I:

Advocated for a co-creation approach to democratize design and bridge gaps between service touchpoints

Conducted internal alignment workshops and introduced service design artifacts (e.g., journey maps, pain point clustering)

Partnered with research to recruit users and apply the RITE method for rapid iteration

Led design strategy and prototyping, working closely with development for fast delivery

Helped reframe wire transfers as a service experience, not just a UI problem.

Beyond design execution, I championed co-creation as a mindset, inviting frontline users and product partners into the design process. This approach built trust across teams and accelerated decision-making by sharing authorship of the solution.

Co-Creation internal presentation slides for advocation with team members

Approach: service-centric, human-informed

Understanding the end-to-end journey

We began with internal research and stakeholder interviews to surface friction across the wire transfer lifecycle—from initiation all the way through to payment received. This involved:

Mapping the current-state service journey, including digital, support, and back-office layers;

Identifying moments of high cognitive load and service breakdowns;

Designing for participation

A funded pilot project presented an opportunity to introduce a co-creation methodology, formalizing a team representing product, research, design and later users.

Initially we aimed to pull participants from the pool of ATB Admin Users who volunteered for trials. After contacting users from the pool, the team faced challenges with participant commitment. This led to exploring alternative methods, ultimately I introduced the Rapid Iterative Testing and Evaluation (RITE) method which was ratified, and we then worked with usertesting.com. This approach offered the necessary intensity for research and design iterations within the project's timeline and the platform had a wide goup of participants already familiar with testing behaviors.

Rapid iteration through co-creation

Wire transfers are digital fund transfers between financial institutions, commonly used internationally and generally faster than cheques. These transfers, once sent, are typically irreversible and can be used for both domestic and international transactions.

Session 1:

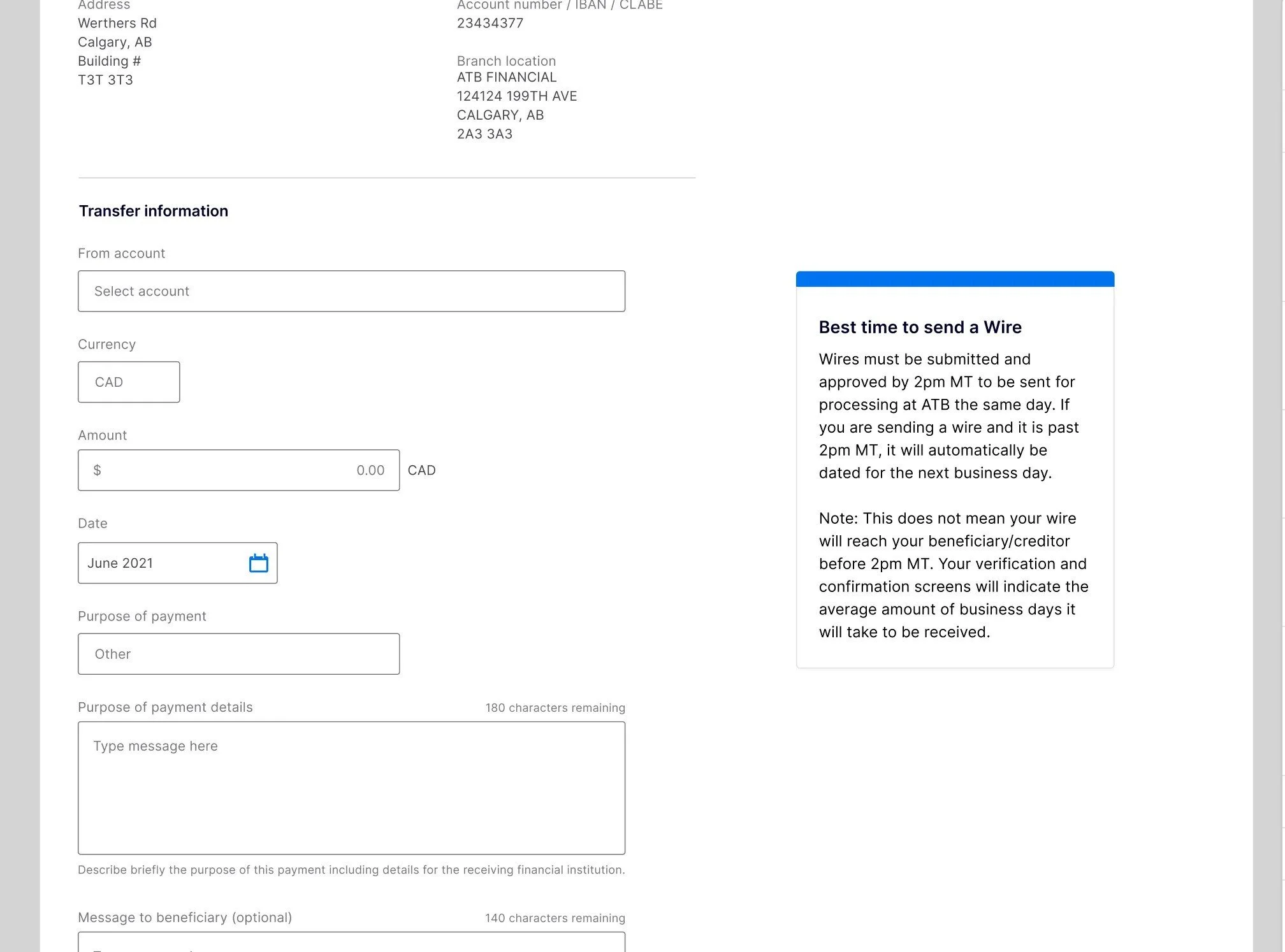

Wire’s information and more were shared in a detailed walkthrough of the existing user experience. Based on this understanding, we created initial sketches to visualize potential improvements and identify key areas for redesign.

Session 2

After one week, the participants were called back to view early prototypes. Participants were walked through on-screen and off-screen interventions. They seemed delighted and invested because of the quick turnaround.

Users gravitated to the info box and Encylopedia which provided more information for wire transfers.

Session 3

Having focused on two key features, we tested assumptions. By presenting multiple versions of the components, we were able to identify usage patterns and refine our design decisions.

Info boxes were standardized to be more in line with business banking and ATB. The Encyclopedia pull-out drawer was refined to include imagery and soften the experience from the feedback from our users. Aesthetics from ATB.com was included and accordions to show/hide information.

Different permutations that were validated

Outcome & Impact

Reduced service load by addressing top call drivers directly in the UI;

1000+ interactions within 3 days, indicating strong early adoption;

3x faster delivery than typical feature work;

set a new precedent for service-aware, co-designed solutions within the organization.

Reflection

This project underscored the power of blending service design and product design. By co-creating with users and internal teams—and treating wire transfers as a service ecosystem—we challenged legacy assumptions, removed systemic barriers, and shipped a solution that worked within and across service layers.

Two different compositions of the info boxes

FInal design for The Drawer

FInal design for the info box

Trends toward success

The new feature resonated immediately, generating almost 1,000 impressions within the first three days, a clear indication that it effectively addressed a crucial user requirement.

Things to come

The future of embedded learning could be incorporated into AI concepts which is another feature we are looking to establish. This is just an assumption though and as our case study shows, co-creation is a valuable methodology for challenging our thought processes and ways of working.

AI offering contextual information

AI Contextual Bar